UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| ☑ | |||

| ☐ |

| CHECK THE APPROPRIATE BOX: | ||||

| ||||

☐ | Preliminary Proxy Statement | |||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |||

☑ | Definitive Proxy Statement | |||

| ☐ |

| |||

| Definitive Additional Materials | |||

☐ | Soliciting Material | |||

AMN Healthcare Services, Inc.

AMN HEALTHCARE SERVICES, INC.

(Name of Registrant as Specified in itsIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||||

| ||||

☑ | No fee | |||

☐ |

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| Fee paid previously with preliminary | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

OUR ASPIRATION

We strive to be recognized as the most trusted, innovative, and influential force in helping healthcare organizations provide a quality patient care experience that is more human, more effective, and more achievable.

OUR MISSION

☐

| DELIVER the best talent and insights to help healthcare organizations optimize their workforce | GIVE | CREATE a values-based culture of innovation where our team members can achieve their goals |

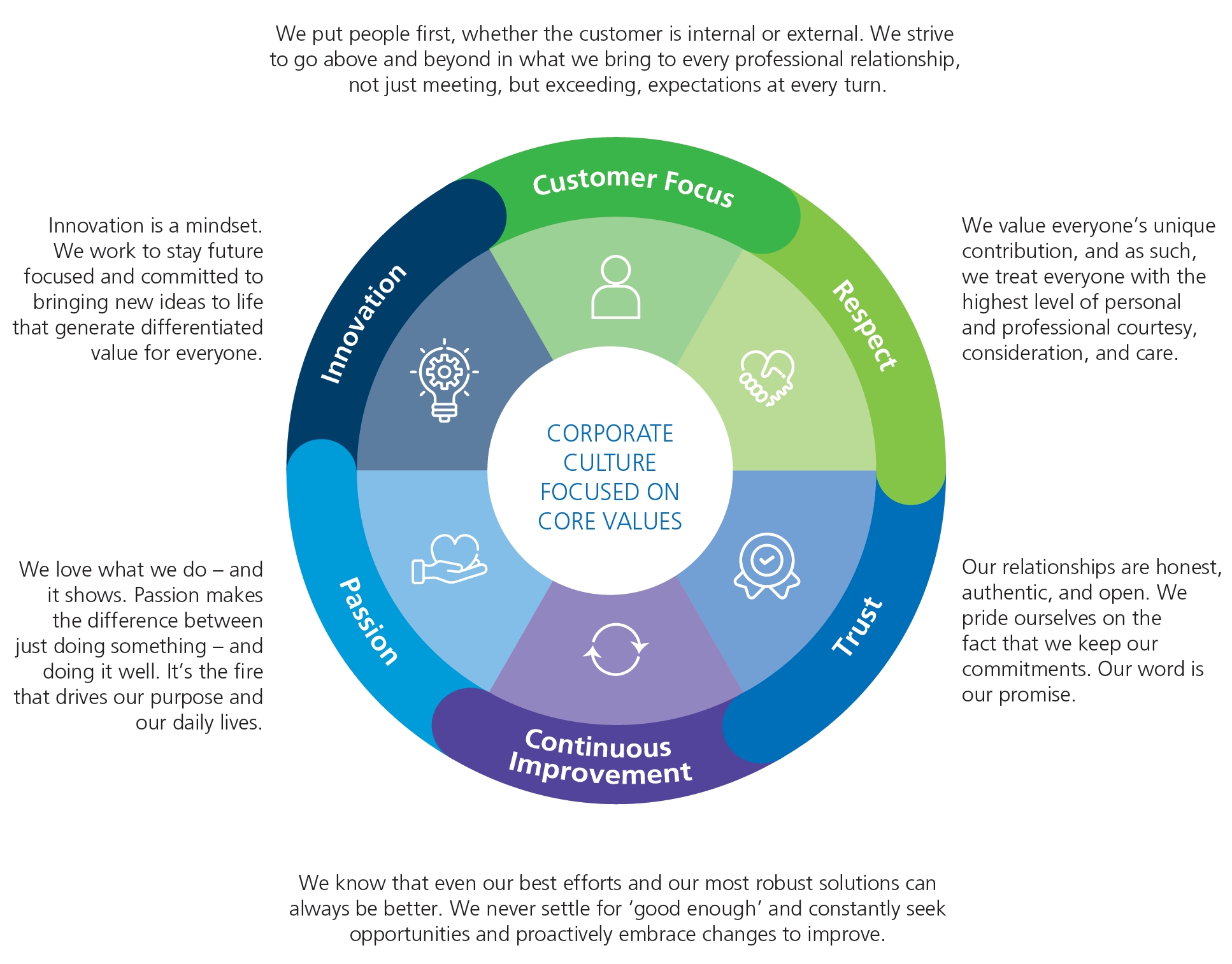

OUR VALUES

|

Dear AMN Healthcare Shareholders,

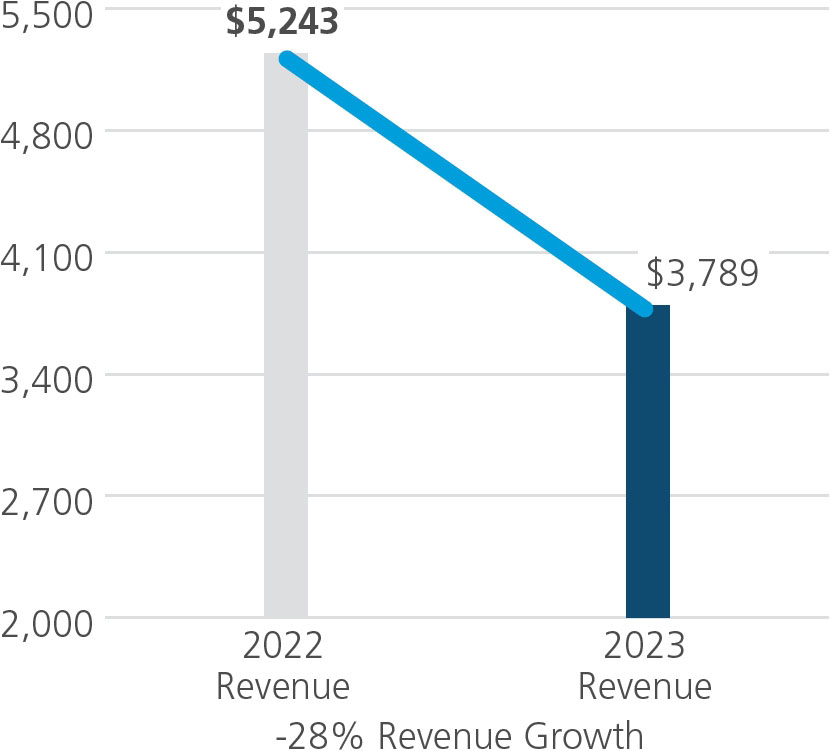

After several years of unprecedented growth supporting our clients during the global pandemic, 2023 was a year of our clients rebuilding their permanent workforces and returning to more normalized utilization of our services. We saw contraction in demand in our businesses that had the most accelerated growth during the pandemic, like our travel nurse business, and we saw continued growth in businesses like locum tenens and language services that grew more normally during the pandemic. We effectively partnered with our clients and healthcare professionals to navigate the once-in-a-generation disruptions to healthcare created by the pandemic while we proactively managed down our expense base as demand for many of our services normalized. We focused on strong financial discipline while investing in initiatives and acquisitions that will strongly position us in the future. Key accomplishments include:

| ● | Strong cash flow generation, with cash flows from operations of $372 million in 2023; |

| ● | Record capital expenditure of more than $100 million directed substantially to initiatives to improve, reinforce, and better deliver our unique value proposition as one operating company and brand; |

| ● | $425 million in share repurchases; and |

| ● | Our Acquisition of MSDR, which strengthens our presence and capabilities in the high-growth locum tenens market. |

Your Board and AMN Healthcare see substantial opportunities ahead as we expect our business to benefit from long-term demand for healthcare professionals and an increasing need for our technology and workforce services. Our growth strategy is centered around positioning ourselves to gain share in a relatively unconsolidated market by supporting clients across a continuum of needs and preferences and serving them with our comprehensive solution set delivered through one platform.

The company is already starting to see the results of the strategic investments and process improvements we put in place this past year, generating momentum that we expect to position us for success in 2024 and beyond. This letter shares a brief overview of the key strategies we expect to drive our growth, the reasons we believe those strategies are right for today’s healthcare market, and the Board and management priorities guiding us for the coming year.

| >220,000 Downloads | Forbes Best Employers For Women 2023 | Newsweek America’s Most Responsible Companies 2020-2023 |

Tech-Centric Total Talent Solutions Company

Our long-term growth is guided by three key pillars which we are aggressively pursuing in 2024:

| ● | Investing in Innovation. In 2023 we directed nearly 50% of capital expenditures to new and enhanced digital programs. These investments are critical to achieving productivity gains, market differentiation and revenue growth. Clients are looking for continued innovation to help them with their workforce challenges and today, more than 30% of AMN Healthcare’s total segment operating income is derived from our technology and workforce solutions segment that helps our clients find the talent they need and optimize their workforce planning and management. We are especially pleased with the progress of our Passport and ShiftWise Flex solutions. As of December 31, 2023, more than 220,000 nurse and allied health professionals use the Passport mobile application to find and apply for jobs, sign contracts, manage credentials, and track pay, time and patient care impact. ShiftWise Flex takes our vendor management system to new heights of effectiveness in automating and streamlining the contingent labor process for nursing, allied health, locums, and non-clinical professionals. Customers benefit from innovations that include expanded labor sourcing channels, easy integration with a healthcare organization’s internal information systems, and data-driven insights from a host of new reporting and dashboard features. |

| 2024 Proxy Statement | AMN Healthcare | 3 |

A Letter from Our CEO & Independent Board Chairman

| ● | Delivering on our Unique Value Proposition as OneAMN. You will increasingly see the company communicate as OneAMN. More than a slogan, our OneAMN initiative that began in 2023 unifies our different company identities and solutions under the powerful, market-leading AMN Healthcare brand experience. It also crystallizes our total talent management approach, underscoring the extensive menu of integrated solutions we bring to clients to meet their permanent, flexible and contingent talent needs. |

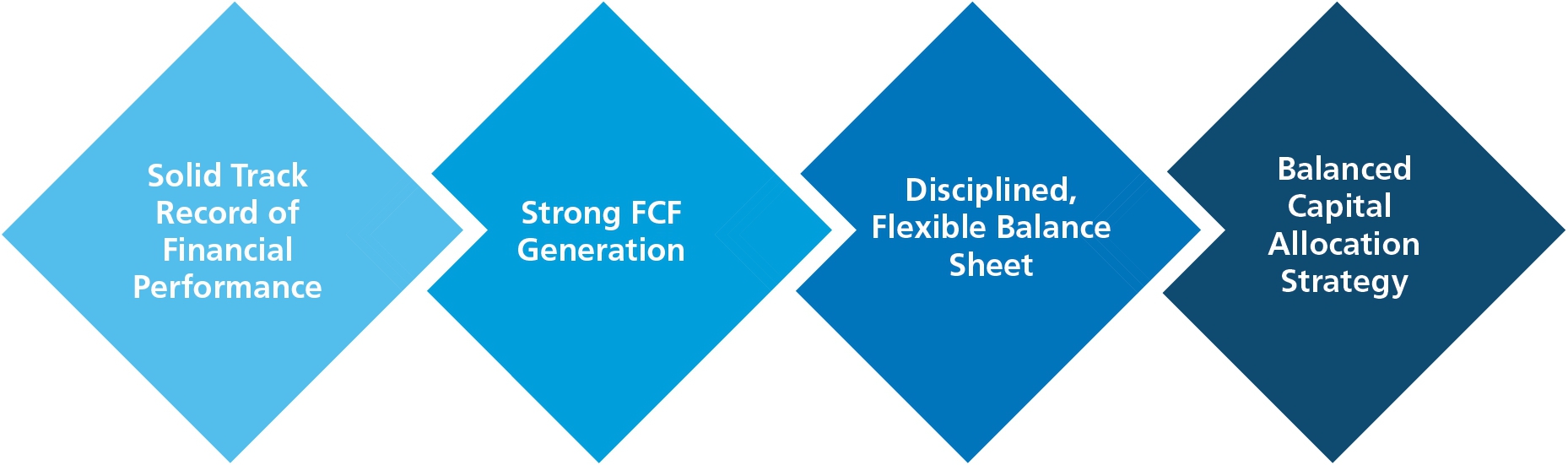

| ● | Maintaining Strong Financial Discipline. Our emphases are to grow profitability through expansion of our higher margin businesses and suite of technology applications, maximizing free cash flow, maintaining targeted capital investment levels, and managing our balance sheet to provide liquidity and borrowing capacity. |

Meeting Healthcare’s Needs

We believe our strategies are powerful because they address the healthcare industry’s most urgent needs. Healthcare organizations need a range of cost-effective, productive talent solutions to deliver on their mission of care. Persistent clinician and administrator shortages driven by structural supply-demand imbalances require effective recruitment and retention of quality talent along with staffing and scheduling optimization. AMN Healthcare’s experience, record of success, integrated and flexible solutions platform, and cultural alignment have made us a partner of choice for healthcare providers.

Management Priorities

AMN Healthcare is focused intently on several priorities we have identified as central to achieving long-term value creation:

| ● | Sustainable Growth. We aim to ensure that our growth is not transitory. That entails continued strategic diversification of revenue streams for effective risk management and market adaptability. |

| ● | Flexible, Tech-Intensive Solutions. Future solutions to the healthcare talent demands and constraints will need to be wider-ranging, more flexible and tech-intensive. We will continue to design our solutions around our customer’s needs and preferences, focused on speed, efficiency and ease of use. |

| ● | Broader and Deeper Engagement with Clients. We see significant opportunities to engage with our clients as their trusted partner for their comprehensive talent needs rather than from a transactional, single-problem perspective. We can take advantage of our broad solutions portfolio and insight from our data analytics to develop deeper long-term relationships with our clients. |

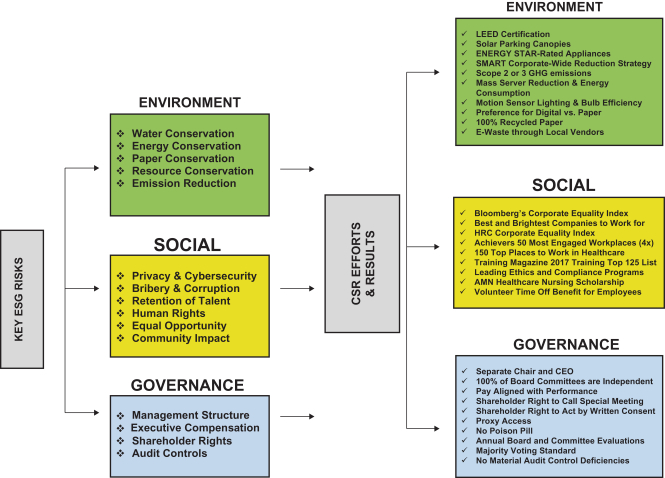

| ● | We have an unwavering commitment to support and create value for our clients, healthcare professionals, employees and communities. As part of that commitment, we continue to perform strongly against our environmental, social, and governance (ESG) objectives, which align with the | |

| ● |

| |

| ||

| ||

|

The Board believes AMN HEALTHCARE 2018 noticeHealthcare is on the right path to deliver on our objectives and reward the commitment of annual meeting & proxy statement The Innovator in Healthcare Workforce solutionsour fellow shareholders. We thank you for your support and staffing services

March 8, 2018

To Our Fellow Shareholders:

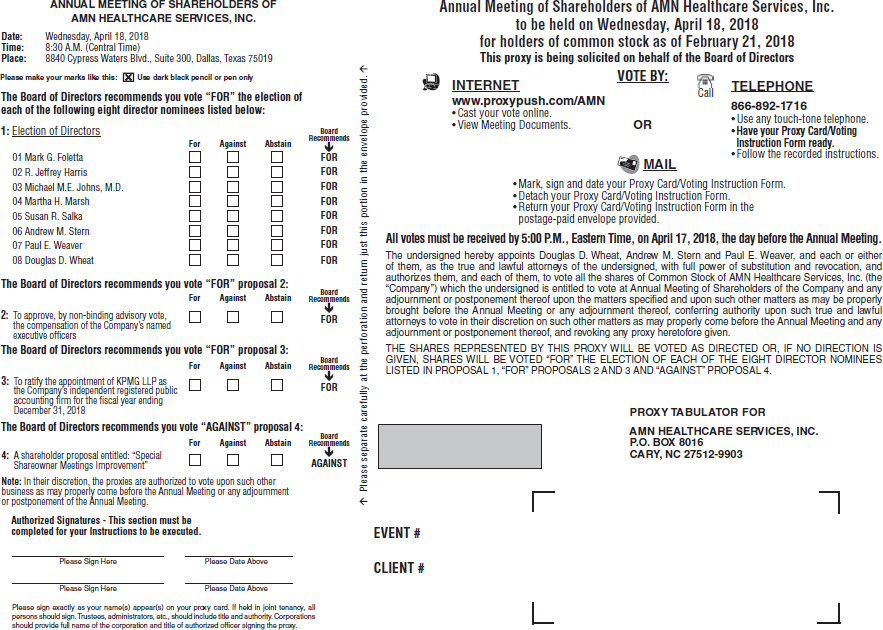

We are pleased to invite you to explore the information in this proxy statement and to attend our 2018 Annual Meeting of Shareholders (the“Annual Meeting”) of AMN Healthcare Services, Inc. at our corporate office located at 8840 Cypress Waters Boulevard, Suite 300, Dallas, Texas 75019 on Wednesday, April 18, 2018,19, 2024 at 8:30 a.m. Central Time. The accompanying formal notice of theWe will conduct our Annual Meeting virtually. We cordially invite you to join us and proxy statement set forth the details regarding admission to thehave included instructions for participating in our Annual Meeting andunder the business to be conducted.

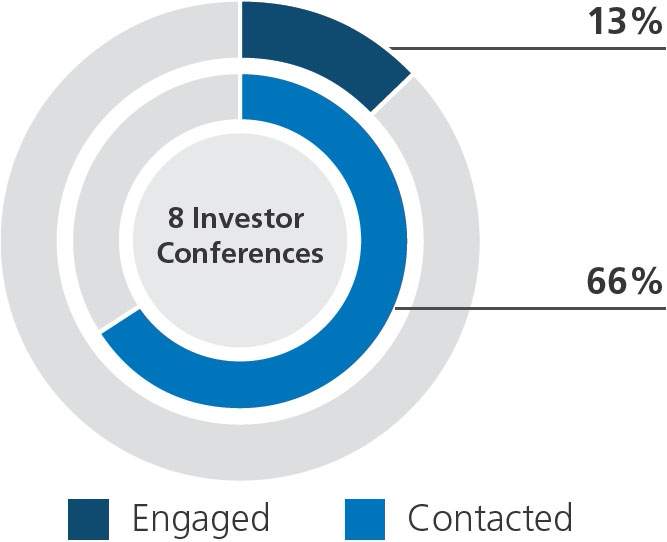

Our annual meetings provide us with yet another opportunity to meet with our shareholders and discuss our strategy, corporate governance, and other related matters. We place high importance on maintaining an ongoing dialogue with our shareholders, and do not limit our conversations to the Annual Meeting. In addition to the Annual Meeting and our discussions at investor conferences, we also engage our shareholders through a formal outreach program in which we invite our shareholders to discuss our culture, corporate governance, executive compensation, corporate social responsibility program, and any other matters that may beGeneral Information Section of interest to them. We found these interactions to be very beneficial and discuss this in more detail in our proxy statement. We truly value communicating with and receiving feedback from our shareholders and look forward to continuing these conversations in 2018.

In connection with the Annual Meeting, we encourage you to review our Annual Report for the fiscal year ended December 31, 2017. The formal notice of the Annual Meeting has been sent to you, along with the proxy statement and proxy card, unless you have elected to receive materials electronically. It is important that your shares be represented and voted, regardless of the size of your holdings. Accordingly, whether or not you plan to attend the Annual Meeting, we encourage you to access the proxy materials and vote online in accordance with the “Notice and Access” letter you will receive so that your shares will be represented at the Annual Meeting. In the alternative, you may also complete, sign, date, and return the proxy card if you wish to receive a full set of proxy materials by mail. Finally, please keep in mind, the proxy is revocable at any time before it is voted and will not affect your right to vote in person if you decide to attend the Annual Meeting.

On behalf of the Board of Directors and the Company, we want to thank you for your ongoing support of and continued interest in AMN Healthcare, and we hope to see you at the Annual Meeting.

Sincerely,

Gratefully Yours,

|

DOUGLAS D. WHEAT Chairman of the Board |

|  CARY GRACE President and Chief Executive Officer |

| 4 | AMN Healthcare | 2024 Proxy Statement |

TABLE OF CONTENTS

| 2024 Proxy Statement | AMN Healthcare | 5 |

| DATE AND TIME April 19, 2024 8:30 a.m. (Central Time) |  | www.virtualshareholdermeeting.com/AMN2024 |  | RECORD DATE February 21, 2024 |

| Voting Matters | |||||||

| Recommendation | Page | ||||||

| 1 | To elect eight directors to the Board of Directors |  | FOR | 15 | |||

| 2 | To approve, by non-binding advisory vote, the compensation paid to named executive officers |  | FOR | 56 | |||

| 3 | To ratify the appointment of KPMG LLP to be our independent registered public accounting firm for the fiscal year ending December 31, 2024 |  | FOR | 102 | |||

| 4 | To approve a proposed amendment and restatement of our certificate of incorporation to provide for exculpation of certain officers of the Company from personal liability under certain circumstances as permitted by Delaware law |  | FOR | 105 | |||

We will also take action upon any other business as may properly come before the 2024 Annual Meeting and any adjournments or postponements of that meeting.

How to Vote Your Shares

| ONLINE Please follow the internet voting instructions sent to you and visit www.proxyvote.com, any time up until 11:59 p.m. (Eastern Time) on April 18, 2024. |  | MAIL If you received printed materials, please mark, date and sign your proxy card per the instructions and return it by mail in the pre-addressed envelope provided. The proxy card must be received prior to the 2024 Annual Meeting to be counted. | ||

| CALL Please follow the telephone voting instructions sent to you and call 1 (800) 690-6903, any time up until 11:59 p.m. (Eastern Time) on April 18, 2024. |  | |||

| |||||

| |||||

| some reason you are unable to attend. |

12400 High Bluff Drive, Suite 100

San Diego, CA 92130

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

| |

|

| |

|

| |

|

|

The Annual Meeting of Shareholders (the “Annual Meeting”) of AMN Healthcare Services, Inc. will beYour vote is important. Please note that if your shares are held at our office located at 8840 Cypress Waters Boulevard, Suite 300, Dallas, Texas 75019 on Wednesday, April 18, 2018, at 8:30 a.m. Central Time,by a bank, broker, or other recordholder and you wish to vote them at any subsequent time that may be necessary by any adjournment or postponement of the Annual Meeting. The purpose of the meeting, is to:you must obtain a legal proxy from that recordholder.

|

|

|

|

The Board of Directors has fixed the close of business on February 21, 2018 as the record date for determining the shareholders of the Company entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. Representation of at least a majority of the voting power represented by all outstanding shares is required to constitute a quorum at the Annual Meeting. Accordingly, it is important that your shares be represented at the Annual Meeting.

We will be using the Securities and Exchange Commission’s Notice and Access model (“Notice and Access”), which allows us to make proxy materials available electronically, as the primary means of furnishing proxy materials. We believe Notice and Access provides shareholders with a convenient method to access our proxy materials and vote. It also allows us to conserve natural resources in alignmentwhich aligns with our Corporate Social Responsibility Program and reducescommitment to sustainability by reducing our environmental footprint as well as reducing the costs associated with printing and distributing our proxy materials. On or about March 8, 2018,5, 2024, we will commence mailing by sending a Notice of Internet Availability of Proxy Materials to our shareholders containingwith instructions on how to access our proxy statement and 20172023 Annual Report, including the financial statements set forth in our annual report on Form 10-K, online and how to cast your vote. The Notice also contains instructions on how to receive a paper copy of the proxy statement and 20172023 Annual Report.

March 8, 2018:

5, 2024

By Order of the Board of Directors,

Denise L. Jackson

WHITNEY M. LAUGHLIN

Chief Legal Officer and Corporate Secretary

San Diego, California

| 6 | AMN Healthcare | 2024 Proxy Statement |

Our Strategy and Total Talent Solutions

AMN Healthcare is a tech-centric total talent solutions company, the leader and innovator in total talent solutions for healthcare organizations across the nation. We offer total talent solutions that enable high quality, flexible workforce and care delivery and we design our services around our customers’ needs and preferences to enable flexible deployment. Across three operating segments, our suite of healthcare workforce solutions includes managed services programs, vendor management systems, medical language interpretation services, predictive labor analytics, workforce optimization technology and consulting, clinical labor scheduling, recruitment process outsourcing, and revenue cycle solutions. We enable our clients to build and manage their workforce in part by leveraging our talent network comprised of thousands of highly skilled healthcare professionals.

| NURSE & ALLIED SOLUTIONS | PHYSICIAN & LEADERSHIP SOLUTIONS | TECHNOLOGY & WORKFORCE SOLUTIONS | ||

WORKFORCE STAFFING |

| TALENT MANAGEMENT |

| 2024 Proxy Statement | AMN Healthcare | 7 |

Proxy Statement Summary

2023 Performance Highlights

Execution of Strategic Imperatives

In 2023, we focused on building sustainable growth across our core service offerings while investing in innovative solutions that we believe will drive value across our portfolio and deliver strong performance for our shareholders.

| ● | Accelerated AMN Healthcare’s Digital Transformation through AMN Passport, our Industry-leading Mobile App |

|

| ● | Enhanced branding initiative to drive greater recognition of the breadth and depth of our presence in the marketplace for healthcare workforce solutions | |||||||

| ● | Enhanced Digital Experience for Clients and Healthcare Professionals | |||||||

| ● | Launched Shiftwise FLEX, the latest generation of our market-leading vendor management system |

Sustained Financial Discipline

Sustainability and Social Impact Our sustainability and social impact strategy is premised on the core belief that achieving measurable results in ESG initiatives provides us with a competitive advantage improving stakeholder engagement, supporting talent acquisition and retention, and driving innovation. Strategic Investments to Enhance Our Value Proposition Our transformative growth over the past two decades has positioned us to lead the digital transformation of the healthcare industry by investing in scalable innovations designed to solve our clients’ greatest workforce challenges, enabling them to deliver on their mission to advance health equity and improve patient outcomes. https://www.amnhealthcare.com/siteassets/amn-insights/news-and-features/amn-healthcare-2023-sustainability-and-social-impact-report.pdf(1) |  |

| (1) | Documents, reports, and information on the Company’s website are not incorporated by reference in this proxy statement. |

| 8 | AMN Healthcare | 2024 Proxy Statement |

PROXY STATEMENT SUMMARYProxy Statement Summary

To assist with your review, thisOur Evolution into a Leader in Total Talent Solutions

Where We Are Making Investments In Technology

| Personalized Digital Experience | Augmented Human Intelligence | Data Analytics Platform | Mobile Applications |

Over 50% of Our Annual Capex is planned for Innovation and Digital Enhancements

| 2024 Proxy Statement | AMN Healthcare | 9 |

The summary below highlights some keycertain information that is contained throughoutmay be found elsewhere in this proxy statement. It does not include all of the informationWe encourage you should consider. We recommend youto read the entire proxy statement before casting your vote. Our proxy statement and other proxyrelated materials are first being made available to our shareholders on or about March 8, 2018.

5, 2024.

Proposal 1 | Election of Our Directors |  | |||||

|

the election of each of the

|  | See |

Directors at a Glance

| 10 | AMN Healthcare | 2024 Proxy Statement |

Proxy Voting Roadmap

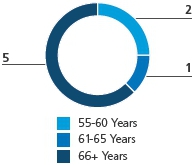

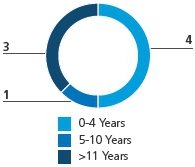

| Age | Tenure | Diversity | ||

|  |  |

Proposal 2 | Advisory Vote to Approve Named Executive Officer Compensation |  | ||

| The Board of Directors recommends a vote “FOR” the approval, on an advisory basis, of the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC. |  | See page 56 |

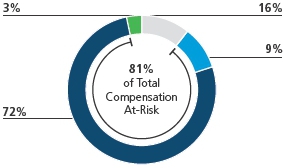

Our executive compensation program adopts a pay-for-performance philosophy structured to balance near-term results with the Company’s long-term success that enables us to attract, retain and appropriately reward our executive team for delivering shareholder value. The Executive Compensation portion of this proxy statement contains a detailed description of our compensation philosophy and programs, the compensation decisions made under those programs with regard to our named executive officers (“NEOs”) for 2023, and the factors considered by the Talent and Compensation Committee in making those decisions. The Board of Directors recommends shareholder approval of the compensation paid to our NEOs as disclosed in this proxy statement.

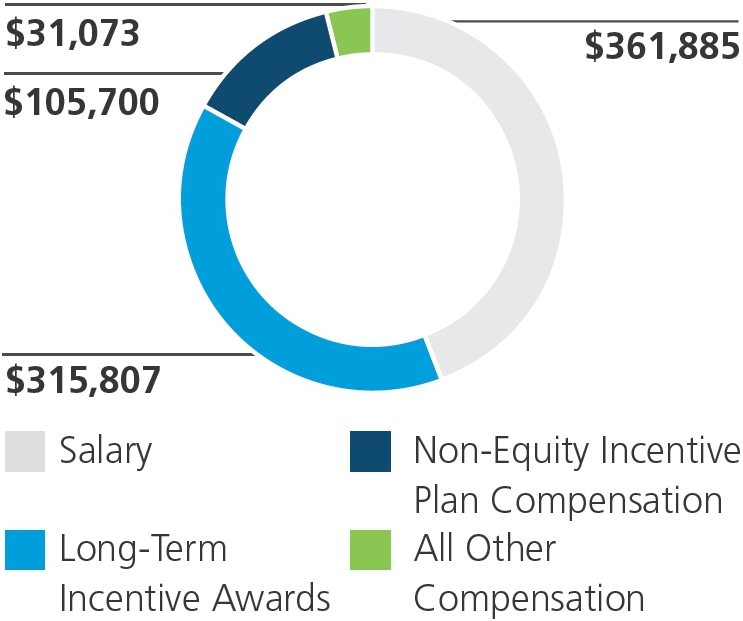

| 2023 CEO Target Compensation Mix |

| Base Salary ●Fixed base of cash compensation | |

| Annual Cash Incentive Bonus ●One-year performance period, aligned with our strategic priorities ●70% of target values are directly tied to measurable financial measures (known as the “Financial” component) ●30% of target values are directly tied to non-financial factors (known as the “Leadership” component) | |

| Equity/Long-Term Incentive ●Three-year performance/vesting period ●Actual payout dependent upon long-term financial and stock performance and retention | |

| All Other Compensation |

| 2024 Proxy Statement | AMN Healthcare | 11 |

Proxy Voting Roadmap

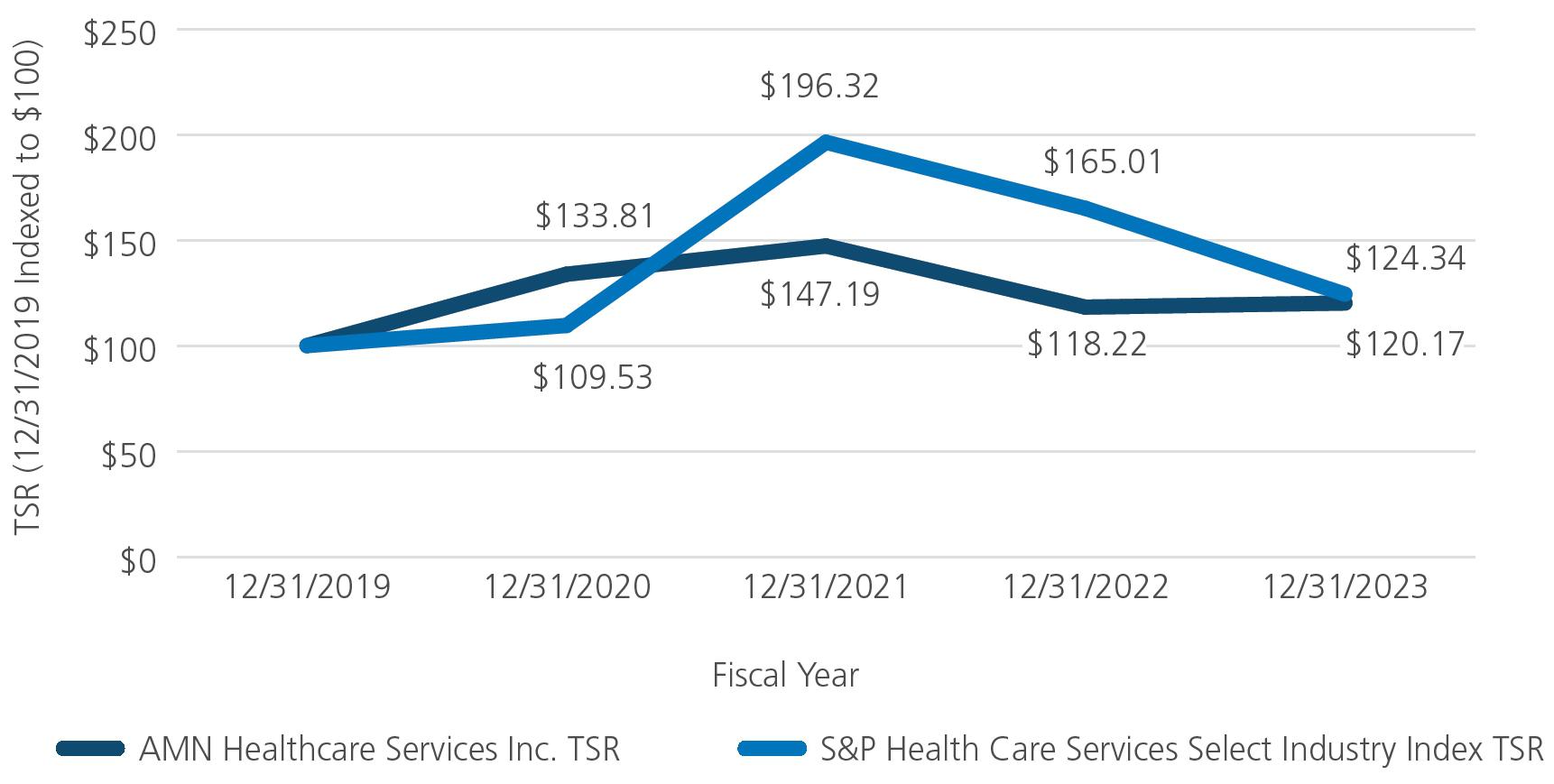

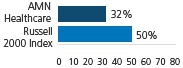

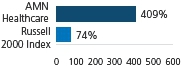

Our Total Return vs. Russell 2000

| 3 Year Total Return (%) | 5 Year Total Return (%) | 10 Year Total Return (%) | ||

|  |  |

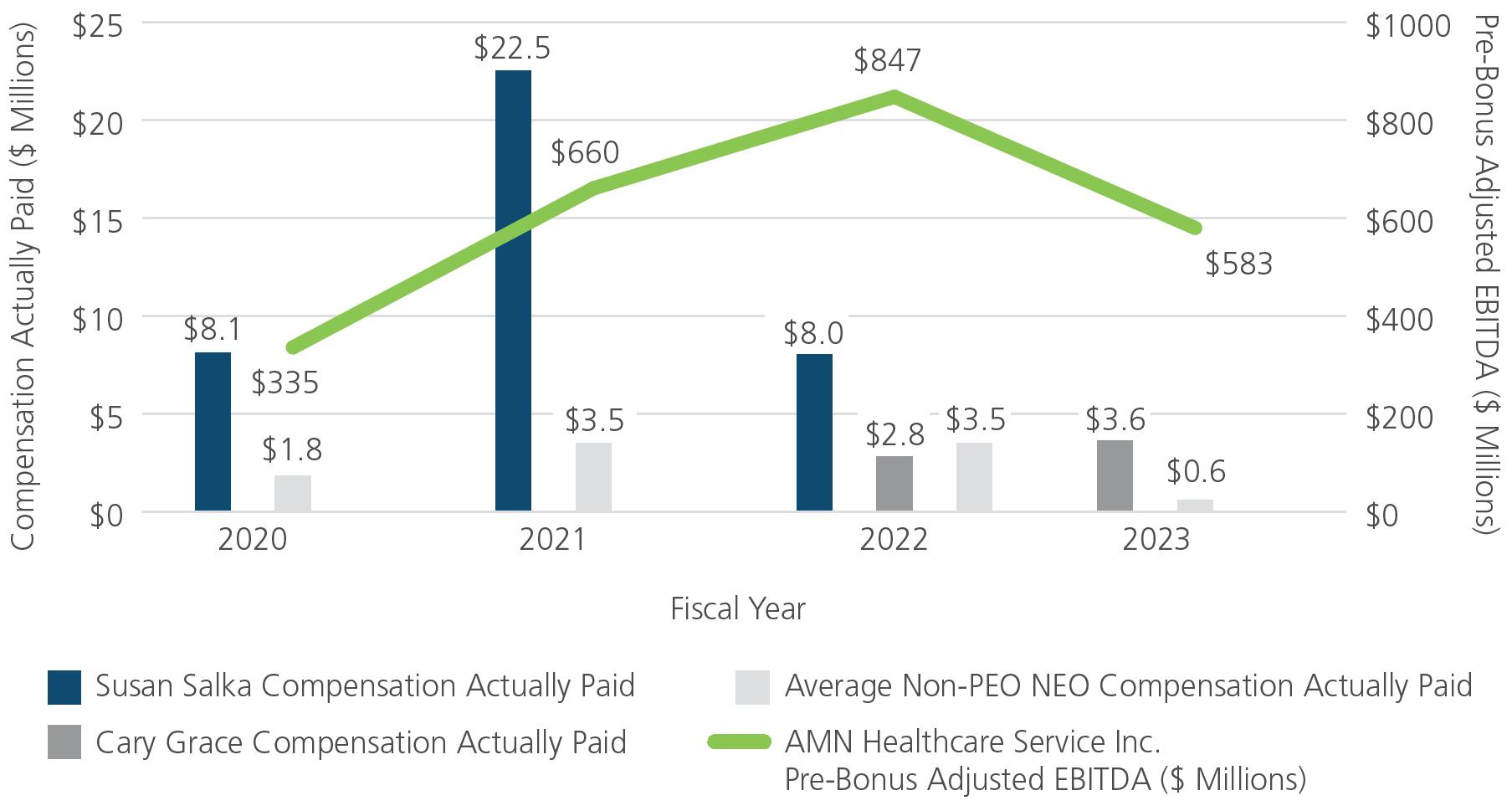

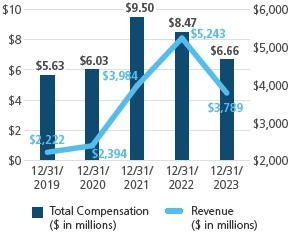

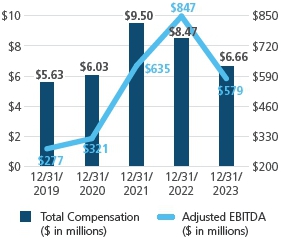

Pay Aligned with Financial Performance

| CEO Compensation vs Revenue(1) | CEO Compensation vs Adjusted EBITDA(1) | |

|  |

Say-on-Pay Results

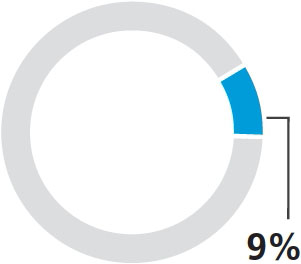

In 2023, we received 92% of votes in favor of our Say-on-Pay proposal (based on shares voting). Since 2015, our Say-on-Pay results have averaged 95% (based on shares voting), which we believe reflects our pay-for-performance philosophy and level of engagement with our shareholders.

Proxy Voting Roadmap•12 AMN Healthcare 2024 Proxy Statement 3:Ratification of the Appointment of KPMG LLP asOur Independent Registered Public Accounting Firm•Proposal 4: Shareholder Proposal to Lower Threshold to 10% to Call a Special Meeting

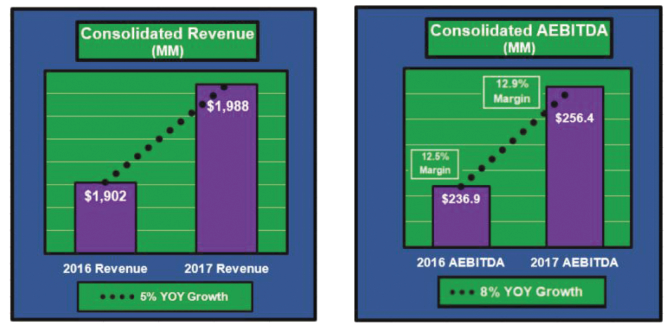

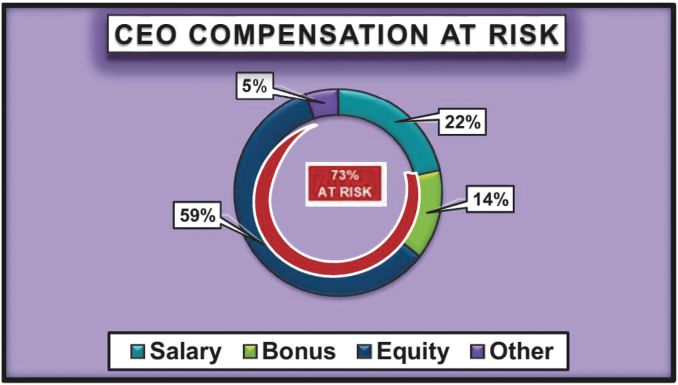

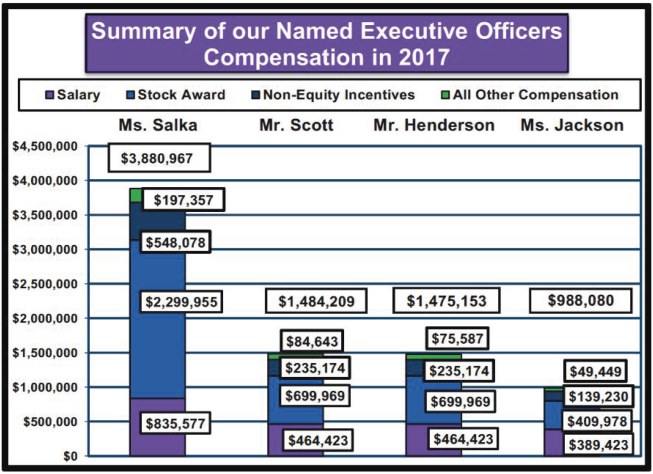

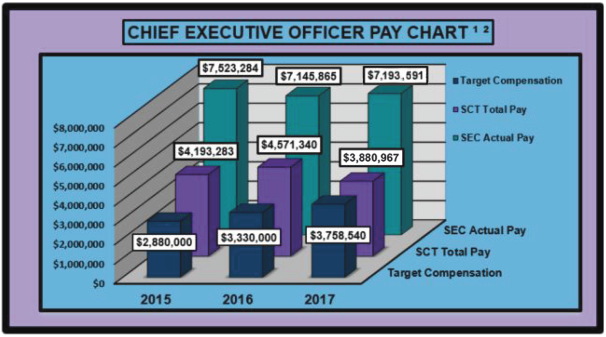

The Board of ShareholdersThe BoardDirectors recommends a vote “FOR” Proposals 2 and 3, and“AGAINST”Proposal 4.EXECUTIVE COMPENSATION(See pages 28 to 61)Susan R. Salka (CEO since 2005)CEO 2017 Total Direct CompensationSalary:$835,577Annual Performance Bonus:$548,078Long-Term Equity Awards:$2,299,955All Other Compensation:$197,357Total Compensation:$3,880,9672017 Compensation Highlights• 73% of 2017 CEO Pay = Incentive compensation (cash and equity) tied to financial performance and shareholder return• Granted performance restricted stock units based on 2019 adjusted EBITDA margin (representing 35% of total equity value granted)• Granted performance restricted stock units based on total shareholder return over a three-year period ending December 31, 2019Pay Aligned with Performance:YesStock Ownership Guidelines:YesRecoupment Policy:YesNo Pledging Policy:YesAMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement1

When and where is the Annual Meeting?

Our 2018 Annual Meeting of Shareholders (the “Annual Meeting”) will be held at our offices located at 8840 Cypress Waters Boulevard, Suite 300, Dallas, Texas 75019 on Wednesday, April 18, 2018, at 8:30 a.m.

Central Time, or at any subsequent time that may be necessary by any adjournment or postponement of the Annual Meeting.

What is “Notice and Access” and why did AMN Healthcare elect to use it?

We are making the proxy solicitation materials available to our shareholders electronically via the Internet under the Notice and Access rules and regulations of the Securities and Exchange Commission (the “SEC”). On or about March 8, 2018, we will mail to our shareholders the Notice of Internet Availability of Proxy Materials (the “Notice”) in lieu of mailing a full set of proxy materials. Accordingly, our proxy materials are first being made available to our shareholders on or about March 8, 2018. The Notice includes information on how to access and review the proxy materials and how to vote online. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials.

Instructions on how to access the proxy materials on the Internet or to request a printed copy may be found in the Notice. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe this method of delivery will decrease costs, expedite distribution of proxy materials to you, and reduce our environmental impact. As a longstanding component of our Corporate Social Responsibility Program, we encourage shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of the Annual Meeting. Shareholders who received the Notice but would like to receive a printed copy of the proxy materials in the mail should follow the instructions in the Notice for requesting such materials.

Why am I receiving these proxy materials?

We are furnishing you these proxy materials in connection with the solicitation of proxies on behalf of our Board of Directors (the “Board”) for use at the Annual Meeting. This proxy statement includes information that we are required to provide under SEC rules and is designed to assist you in voting your shares.

Proxies in proper form received by us at or before the time of the Annual Meeting will be voted as specified. You may specify your choices by marking the appropriate boxes on your proxy card. If a proxy card is

dated, signed and returned without specifying choices, the proxies will be voted in accordance with the recommendations of the Board set forth in this proxy statement, and, in their discretion, upon such other business as may properly come before the Annual Meeting. Business transacted at the Annual Meeting will be confined to the purposes stated in the Notice of Annual Meeting. Shares of our common stock, par value $0.01 per share (“Common Stock”), cannot be voted at the Annual Meeting unless the holder is present in person or represented by proxy.

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions on how to (1) view our proxy materials for the Annual Meeting on the Internet, and (2) instruct us to send proxy materials to you by email. The proxy materials are also available under the “Investor Relations” tab on our website at

www.amnhealthcare.com. Choosing to access our proxy materials electronically will save us the cost of printing and mailing documents to you, and will reduce the impact of our annual meetings on the environment.

2 AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement

What is included in the proxy materials?

Our proxy materials include:

Our Notice of Annual Meeting of Shareholders,

This proxy statement, and

|

If you receive a paper copy of these materials by mail, the proxy materials will also include a proxy card.

Who pays the cost of soliciting proxies for the Annual Meeting?

Proxies will be solicited on behalf of the Board by mail, telephone, email or other electronic means or in person, and we will pay the solicitation costs. We will supply our proxy materials, including our 2017 Annual Report, to brokers, dealers, banks and voting trustees, or their

nominees for the purpose of soliciting proxies from beneficial owners, and we will reimburse them for their reasonable expenses. We have retained MacKenzie Partners, Inc. to assist in soliciting proxies for a fee of $9,000, plus reasonableout-of-pocket expenses.

Who is entitled to vote at the Annual Meeting?

In accordance with our Amended and RestatedBy-laws (the “Bylaws”), the Board has fixed the close of business on February 21, 2018, as the record date (the “Record Date”) for determining the shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. At the close of business on the

Record Date, the outstanding number of our voting securities was 47,818,707 shares. Each shareholder is entitled to one vote for each share of Common Stock he or she held as of the Record Date. Shares cannot be voted at the Annual Meeting unless the holder is present in person or represented by proxy.

What matters will be addressed at the Annual Meeting?

At the Annual Meeting, shareholders will be asked:

To elect the eight directors nominated by the Board and named in this proxy statement,

To approve, bynon-binding advisory vote, the compensation of our named executive officers,

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018, and

To transact such other business, including consideration of a shareholder proposal, if properly presented, as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

What is the vote required for each proposal and what are my choices?

|

|

| ||

|

| |||

|

| |||

|

| |||

|

| |||

AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement3

With respect to Proposal 1, the election of directors, you may vote FOR, AGAINST or ABSTAIN. Our Bylaws require that in an election where the number of director nominees does not exceed the number of directors to be elected, each director will be elected by the vote of the majority of the votes cast (in person or by proxy). A “majority of votes cast” means that the number of shares cast “FOR” a director’s election exceeds the number of votes cast “AGAINST” that director’s election. In accordance with our Bylaws, the following do not count as votes cast: (a) a share whose ballot is marked as withheld, (b) a share otherwise present at the meeting, but for which an ABSTAIN vote was cast, and (c) a share otherwise present at the meeting as to which a shareholder gives no authority or direction. In an uncontested election, a nominee who does not receive a majority of the votes cast will not be elected. An

incumbent director who is not elected because he or she does not receive a majority of the votes cast will continue to serve as a holdover director, but will tender his or her resignation to the Board. Within 90 days after the date of the certification of the election results, the Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken, and the Board will act on the Corporate Governance Committee’s recommendation and publicly disclose its decision and rationale.

With respect to Proposals 2, 3 and 4 (or on any other matter to be voted on at the Annual Meeting), you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposals 2, 3 or 4, the ABSTAIN vote will have the same effect as an AGAINST vote.

How does the Board recommend that I vote?

The Board recommends that you vote:

|

|

|  | See page 102 |

|

How do I vote my shares?

|

|

|

|

|

If you are a beneficial owner and your shares are held through a broker, you should followIn February 2024, the instructionsAudit Committee appointed KPMG LLP (“KPMG”) to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. KPMG has been retained as the Company’s independent registered public accounting firm continuously since 2001. The Audit Committee is directly involved in the Notice provided by your broker, or your broker should provide instructions for voting your shares. In these cases, you may vote by Internet, telephone or mail,annual review and engagement of KPMG to ensure continuing audit independence, and the Audit Committee and the Board believe that the continued retention of KPMG to serve as applicable. You may vote your shares beneficially held through your brokerthe Company’s independent registered public accounting firm is in person if you attendthe best interests of the Company and its shareholders. See “Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees” on page 103 and “Report of the Audit Committee of the Board of Directors” on page 103. Representatives of KPMG are expected to participate in the Annual Meeting, where they will be available to respond to appropriate questions and, you obtainif they desire, to make a valid proxy card from your broker giving you the legal right to vote the shares at the Annual Meeting.statement.

4 AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement

Proposal 4 | Approval of a Proposed Amendment and Restatement of Our Certificate of Incorporation to Provide for Officer Exculpation |  | ||||||||

| The Board of Directors recommends a vote “FOR” the approval of a proposed amendment and restatement of the Company’s Amended and Restated Certificate of Incorporation to provide for exculpation of certain officers of the Company from personal liability under certain circumstances as permitted by Delaware law. |  | See page 105 |

WhatEffective August 1, 2022, the State of Delaware, which is the difference between shareholderCompany’s state of record and beneficial owner?

Shareholderincorporation, enacted legislation that permits Delaware companies to limit the liability of Record. You are a shareholder of record if at the close of business on the Record Date your shares were registered directly in your name with American Stock Transfer & Trust Company, LLC, our transfer agent.

Beneficial Owner. You are a beneficial owner if at the close of business on the Record Date your shares were held by a brokerage firm or other nominee and not in

your name. Being a beneficial owner means that, like most of our shareholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee on how to vote your shares by following the voting instructions your broker or other nominee provides. If you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee will be able to vote your shares as described below.

What will happen if I do not vote my shares?

Shareholders of Record.If you are the shareholder of record and you do not vote by proxy card, telephone, Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner and you do not direct your broker or nominee on how to vote your shares, your broker or nominee may vote your shares only on those proposals for which it has

discretion to vote. Under the rules of the New York Stock Exchange (“NYSE”). Your broker or nominee does not have discretion to vote your shares onnon-routine matters such as Proposals 1, 2 and 4. We believe that Proposal 3 — ratification of our auditor — is a routine matter for which brokers and nominees can vote on behalfcertain of their clients when voting instructionsofficers in limited circumstances. In light of this update, we are not furnished by their clients.

What isproposing to amend and restate the effectCompany’s Amended and Restated Certificate of a brokernon-vote?

Brokers or other nominees who hold shares for a beneficial owner have the discretionIncorporation to vote on routine proposals when they have not received voting instructions from the beneficial owner at least ten days prior to the Annual Meeting. A brokernon-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Brokernon-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but

will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote with respect toauthorize exculpating certain proposals. Accordingly, a brokernon-vote will not impact our ability to obtain a quorum nor will it impact any vote that requires a majority of the votes cast (Proposal 1) or any proposal that requires the majority of the shares entitled to vote and present or represented by proxy (Proposals 2, 3 and 4).

May I revoke my proxy or change my vote?

Yes, you may revoke a proxy you have given at any time before it is voted at the Annual Meeting by (1) sending our Corporate Secretary a letter revoking the proxy, which must received prior to the Annual Meeting, or (2) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting does not, standing alone, constitute your revocation of a proxy.

You may change your vote at any time prior to the voting of your shares at the Annual Meeting by (a) casting a new vote by telephone or over the Internet by 5:00 p.m., Eastern Time, on the date before the day of the Annual Meeting, or (b) sending a new proxy card with a later date that is received prior to the Annual Meeting.

How can I find the results of the Annual Meeting?

We will announce preliminary results at the Annual Meeting. We will publish final results in a current report on Form8-K that we will file with the SEC within four business days after the Annual Meeting.

If the official results are not available at that time, we will provide preliminary voting results in the Form8-K and will provide the final results in an amendment to the Form8-K as soon as they become available.

AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement5

ELECTION OF OUR DIRECTORS

The Board is elected by the shareholders to oversee their interest in the overall success of the Company’s businessofficers from liability in certain specific circumstances, as permitted by Delaware law. After careful consideration, the Board determined that it is in the best interests of the Company and financial strength. The Board serves asour shareholders to amend and restate the Company’s ultimate decision-making body to the extent

set forth in ourAmended and Restated Certificate of Incorporation and Bylaws. It also selects and oversees our senior executives, who, in turn, oversee ourday-to-day business and affairs.as described herein.

| 2024 Proxy Statement | AMN Healthcare | 13 |

Our Nominees for the Board

Proposal 1 | Election of Our Directors |  | |

| The Board of Directors recommends a vote FOR the election of each of the director nominees. |

Eight directors are to be elected at theour 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to hold office until our next annual meeting or until their successors are duly elected and qualified, or until the director retires, resigns, is removed or becomes disqualified. In February 2024, one of our directors, Ms. Martha Marsh, informed the Board of her decision not to stand for re-election at the Annual Meeting. As a result of Ms. Marsh’s decision not to stand for re-election, the Board approved a decrease in its size to eight members, effective upon the election of the Company’s directors at the Annual Meeting.

The proxy will be voted in accordance with the directions stated on the card, or, if no directions are stated, for election of each of the eight nominees listed below. Upon the recommendation of the Board’s Corporate Governance and Compliance Committee the members of(the “Governance and Compliance Committee”), the Board havehas nominated for election the eight directors listed below, all of whom are currently serving as directors on our eight current directors.Board. The director nominees for election named below are willing to be duly elected and to serve. If any such nominee is not a candidate for election at the Annual Meeting, an event that the Board does not anticipate, the proxies willmay be voted for a substitute nominee(s).

The business experience, board service, qualifications and affiliations of our director nominees are set forth below. We believe we have a slate of director nominees that are well-positioned to represent our shareholders and oversee the Company’s strategy, business operations and financial strength.

AMN Healthcare Board of Directors

The Board represents a range of characteristics, skills and experiences in areas that are relevant to and contribute to the Board’s oversight of the Company’s strategic objectives and to reflect a diversity of personal backgrounds. Diversity of race, ethnicity, gender and age are taken into account in director nominations. We believe a diverse organization, including our Board, leads to innovation and successful outcomes. Below, we include the demographic information for each director nominee and describe the key experiences, qualifications, skills and attributes the director nominee brings to the Board that, for reasons discussed in the chart below, are important to our businesses and strategic objectives. The Board considered these key experiences, qualifications, skills and attributes and the nominees’ other qualifications in determining to recommend that they be nominated for election.

Director Nominee Snapshot

|

|

| ||||||

| Independence | ||||||||

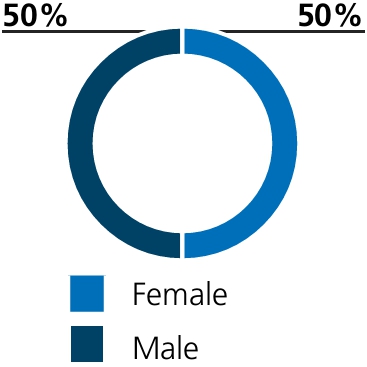

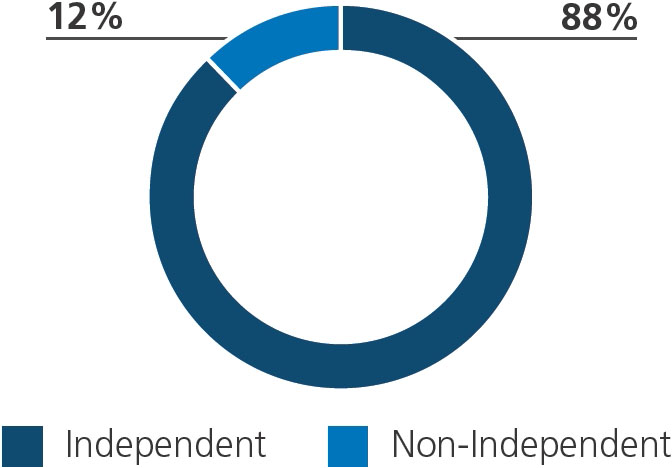

| Average Less than 10 years | Average 65 years | 50% Female | 38% BIPOC | 88% Independent Directors | ||||

|  |  |  |  |

| 2024 Proxy Statement | AMN Healthcare | 15 |

Corporate Governance

Skills and Experience

|  |  |  |  |  |  |  | ||

| Skills, Competency or Attribute | Caballero | Foletta | Fontenot | Grace | Harris | Jones | Trent- Adams | Wheat | |

| Healthcare Industry | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| C-Suite Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Finance/Audit | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Legal/Risk Management | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Mergers & Acquisitions | ✓ | ✓ | ✓ | ✓ | ||||

| Human Capital Management | ✓ | ✓ | ✓ | |||||

| Government/Policy Advocacy | ✓ | ✓ | ||||||

| Digital/Technology | ✓ | ✓ | ||||||

| Demographic Background | |||||||||

| Tenure | 2 | 11 | 4 | 1 | 18 | 5 | 3 | 24 | |

| Gender | M | M | F | F | M | F | F | M | |

| Race/Ethnicity | |||||||||

| African American or Black | ✓ | ✓ | |||||||

| Hispanic or Latinx | ✓ | ||||||||

| White | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| 16 | AMN Healthcare | 2024 Proxy Statement |

Corporate Governance

| Healthcare Industry | ||

| We generally seek directors who have knowledge of and experience in the healthcare industry, which is useful in understanding the needs, regulatory requirements and complexities of our clients and healthcare professionals. |  | ||

| |||

| We believe that directors who have served in executive positions are important because they have the experience and perspective to analyze, shape and oversee our strategy and the growth and preservation of shareholder value. |  | ||

| |||

| We are committed to strong financial discipline, effective allocation of capital and accurate disclosure practices. We believe that financial expertise on the Board is instrumental to our success. |  | ||

| |||

| We operate in a constantly changing and increasingly complex regulatory environment. Directors with regulatory compliance oversight and enterprise risk management experience play an important role in the Board’s ability to oversee our enterprise risk management program and legal and compliance risks. |  | ||

| Mergers & Acquisitions | ||

| We believe that our ability to achieve our long-term growth objectives will require a combination of organic growth and growth by acquisition. We believe that M&A expertise on the Board provides valuable insight and oversight of our growth strategies and achievement of financial goals. |  | ||

| Human Capital Management | ||

| We have a large and diverse workforce which represents one of our key resources as well as one of our largest expenses. We believe experience in managing a large workforce is important to ensure that we have sufficient talent, robust development and retention practices and maintain our commitment to diversity, equity and inclusion. |  | ||

| Government/Policy Advocacy | ||

| We operate in a changing healthcare industry. State and federal government experience and an understanding of policy development enhance the Board’s ability to provide effective oversight of government policy and regulatory risk. |  | ||

| Digital/Technology | ||

| Our business has become increasingly complex as we have accelerated our digital transformation and expanded our service offerings to include more technology related solutions. This digital transformation requires a sophisticated level of technology resources and infrastructure as well as technological expertise, and, accordingly, we believe digital transformation expertise on the Board contributes to our success. |  | ||

| 2024 Proxy Statement | AMN Healthcare | 17 |

Corporate Governance

Director Biographies

Set forth below is a brief description of the backgrounds and qualifications of each director. These, along with the skills and experience described earlier in this section, led the Board to conclude that the director should be nominated for election at the 2024 Annual Meeting.

| Jorge A. Caballero | 67 Committee: Audit Committee (Financial Expert); Corporate Governance and Compliance Committee (Chair) Director Since: 2021 | Skills & Qualifications: Finance/Audit | Mergers & Acquisitions | Legal/Risk Management  |

| Qualification Highlights ●Managing Partner of Deloitte’s Business Tax Services U.S.-India practice (2016 – 2019) ●New Jersey Tax Managing Partner of Deloitte (2003 – 2011) ●Assistant Vice President of Tax of Beneficial Corporation, a consumer finance company that was acquired by Household International, Inc. in 1998 (1983 – 1986) |

|

6 AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement

| Mr. Caballero brings to the Board significant public company accounting and financial reporting expertise and a top-level perspective in organizational management. Mr. Caballero’s career has provided him with practical knowledge of executive management of complex, global businesses and extensive experience in a wide range of financial and accounting matters including management of global financial operations, financial oversight, risk management and the alignment of financial and strategic initiatives. Mr. Caballero also brings deep corporate governance experience through his work with public and private companies and in his board leadership positions at Deloitte and extensive experience in mergers and acquisitions, a critical component to the Company’s growth strategy. The Board has determined that Mr. Caballero qualifies as an audit committee financial expert and has appointed him to the Audit Committee. Mr. Caballero serves as the Chair of the Corporate Governance and Compliance Committee. |

|

| Skills & Qualifications: Finance/Audit | Healthcare Industry | C-Suite Leadership | Legal/Risk Management  |

| ||||||||||||||

| ||||||||||||||

Qualification Highlights ●Executive Vice President and Chief of Tocagen ●Interim Chief Financial Officer of Biocept, Inc., a publicly traded diagnostics company (August 2015 – July 2016) ●Senior Vice President, Finance and Chief Financial Officer of Amylin Pharmaceuticals, Inc. (March 2006 – October 2012) ●Vice President, Finance and Chief Financial Officer of Amylin (March 2000 – March 2006) ●Certified Public Accountant (inactive) and a member of the Corporate Directors Forum | ||||||||||||||

Board Experience ●DexCom, Inc., a publicly traded diabetes care technology company, where he is the Lead Independent Director (November 2014 – present) ●Enanta Pharmaceuticals, a publicly traded biotechnology company, where he is the Chair of the Audit Committee (June 2020 – present) ●Regulus Therapeutics Inc., where he served as Chair of the Audit Committee and a member of the Nominating and Governance Committee (February 2013 – June 2018) ●Viacyte, Inc., a privately held company (sold in 2022) ●Ambit Biosciences Corporation, where he served as Chair of the Audit Committee (sold in 2014) ●Anadys Pharmaceuticals, Inc. (sold in 2011) | ||||||||||||||

| Mr. Foletta brings to the Board considerable audit, financial, healthcare and enterprise risk management experience as both an executive officer and director of healthcare companies. Mr. Foletta assisted with developing and launching the initial enterprise risk management assessment at Amylin Pharmaceuticals and guided the launch of the initial risk management assessment at both Regulus and DexCom. Mr. Foletta’s prior experience as a public company CFO provides the Board with extensive public company accounting and financial reporting expertise to guide the Company’s commitment to strong financial discipline, effective allocation of capital and accurate disclosure practices. The Board has determined that Mr. Foletta qualifies as an audit committee financial expert and has appointed him to the Audit Committee. | ||||||||||||||

| 18 | AMN Healthcare | 2024 Proxy Statement |

Corporate Governance

| Teri G. Fontenot | 70 Committee: Audit Committee (Chair) (Financial Expert) Director Since: 2019 | Skills & Qualifications: Finance/Audit | Healthcare Industry | Government/Policy Advocacy | C-Suite Leadership | Human Capital Management  |

| Qualification Highlights ●President and CEO of Woman’s Hospital, the largest independently-owned women’s and infant’s hospital in the United States providing comprehensive subspecialty services to women (March 1996 – March 2019) ●Chief Financial Officer and Executive Vice President of Woman’s Hospital (1992 – 1996) ●Chief Financial Officer of three other hospitals located in Louisiana and Florida prior to joining Woman’s Hospital (1985 – 1992) ●Certified Public Accountant (inactive) ●Advisory Committee on Research on Women’s Health for the National Institutes of Health (1999 – 2005) | ||

Board Experience ●Amerisafe, Inc., a publicly traded specialty provider of workers’ compensation insurance, where she serves on the Audit, Risk and Governance Committees (June 2016 – present) ●Orlando Health, Inc., a not-for-profit organization, where she serves on the Executive and Clinical Quality Committees (September 2021 – present) ●Baton Rouge Water Company (2009 – Present) and Dynamic Access Therapy (May 2021 – present) both privately held companies ●LHC Group, Inc., a publicly traded in-home healthcare services company, where she served on the Clinical Quality and Corporate Development Committees and as Chair of the Audit Committee (2019 until its sale to United Healthcare in February 2023) ●Landauer (a formerly publicly traded company), where she served on its Audit and Governance Committee, until its sale in 2017 ●PELITAS, a privately held company (June 2021 until its sale in 2022) ●Sixth District Federal Reserve Bank of Atlanta, including as its Audit Committee chair for two years (2004 – 2009) ●Served on numerous healthcare boards at a local, state and national level, including the Board of Directors of the Louisiana Hospital Association, and the American Hospital Association where she served as Chairperson (2012) | ||

| Ms. Fontenot brings substantial operational and strategic experience in the healthcare industry as a former chief executive officer and chief financial officer of four healthcare institutions and as a board member for healthcare-related organizations. Ms. Fontenot’s more than 30 years in healthcare and finance leadership provides valuable insights into the Company’s strategic discussions regarding the dynamic economic environment and healthcare industry and continued development of client-centric total talent solutions. The Board has determined that Ms. Fontenot qualifies as an audit committee financial expert and has appointed her as Chair of the Audit Committee. |

| Cary Grace | 55 Committee: Executive Committee Director Since: 2022 | Skills & Qualifications: C-Suite Leadership | Mergers & Acquisitions | Digital/Technology | Finance/Audit | Human Capital Management | Legal/Risk Management | Healthcare Industry  |

| Qualification Highlights ●President and CEO of AMN Healthcare Services, Inc. (November 2022 – present) ●Chief Executive Officer of the Global Retirement, Investment and Human Capital Solutions business at Aon PLC (2016 – January 2020) ●Various Executive Leadership Positions within AON, including CEO of AON Health Exchanges (2012 – 2019) ●Bank of America, where she led several institutional and private banking businesses, including their $9 billion Mass Affluent Client Business (1998 – 2012) | ||

Board Experience ●State Farm Insurance, a mutual company offering auto, home, life and health insurance as well as investment services (2022 – present) ●League, Inc., a privately held digital platform and technology company empowering consumer health engagement (2020 – present) ●FinTech Evolution Acquisition Group, where she served as Chair of the Audit Committee (2021 – March 2023) | ||

| Ms. Grace brings to the Board more than three decades of experience developing and executing profitable growth strategies for leading professional and financial services organizations across human capital, banking, investments, health, and mergers and acquisitions, including most recently at AON, where Ms. Grace led AON’s Global M&A integration team, its Enterprise Client Management function as well as its digitally enabled private health exchanges. While at AON, Ms. Grace also served on its Policy and Governance Team, served on the Operating Committee and was named an executive officer of the corporation. Ms. Grace’s extensive experience in leading initiatives and services with a focus on digital enablement provides valuable insight and leadership as the Company continues to evolve and develop technology related and enabled solutions for clients and healthcare professionals. Ms. Grace is also a passionate advocate for diversity and inclusion and with deep knowledge of environmental, social and governance (ESG) in business, causes closely tied to the Company’s purpose and values and a key differentiator providing a competitive advantage. |

| 2024 Proxy Statement | AMN Healthcare | 19 |

Corporate Governance

| R. Jeffrey Harris | 69 Committee: Corporate Governance and Compliance Committee; Talent and Compensation Committee; Executive Committee Director Since: 2005 | Skills & Qualifications: Legal/Risk Management | Mergers & Acquisitions | Healthcare Industry | C-Suite Leadership  |

| Qualification Highlights ●Of Counsel at Apogent Technologies, Inc., a laboratory, life science and diagnostic products company (December 2000 – 2003) ●Vice President, General Counsel and Secretary at Apogent Technologies, Inc., formerly Sybron International (1988 – 2000) | ||

Board Experience ●Sybron Dental Specialties until it was acquired by Danaher Corporation (April 2005 – 2006) ●Playtex Products, Inc. until it was acquired by Energizer Holdings (2001 – October 2007) ●Prodesse, Inc., an early-stage biotechnology company, until it was acquired by Gen-Probe Incorporated (2002 – 2009) ●Apogent Technologies, Inc. until it was acquired by Fisher Scientific International, Inc. (2000 – 2004) ●Guy & O’Neill, Inc., a privately held private label and contract manufacturing company (2008 – 2018) ●President, board member (former Chairman) and a co-founder of BrightStar Wisconsin Foundation, Inc., a non-profit economic development corporation (2013 – 2021) | ||

| Mr. Harris brings considerable mergers and acquisitions experience to the Board, which is a key component of the Company’s growth strategy. Mr. Harris’ legal, regulatory and corporate governance expertise provides valuable insights to the Board and Management as we operate in a constantly changing and increasingly complex regulatory environment and strive to deliver industry-leading results supported by strong governance and compliance practices. |

|

Daphne E. Jones | 66 Committee: Audit Committee; Corporate Governance and Compliance Committee Director Since: 2018 | Skills &

Digital/Technology | Healthcare Industry | C-Suite Leadership  |

| Qualification Highlights ●Senior Vice President, Digital/Future of Work for GE Healthcare, the healthcare business of GE (May 2017 – October 2017) ●Senior Vice President, Chief Information Officer for GE Healthcare Diagnostic Imaging and Services (August 2014 – May 2017) ●Senior Vice President, Chief Information Officer for Hospira, Inc., a provider of pharmaceuticals and infusion technologies (October 2009 – June 2014) ●Chief Information Officer at Johnson & Johnson (2006 – 2009); served in various information technology roles with Johnson & Johnson (1997 – 2006) ●Founder, The Board Curators, LLC (July 2021 – present) ●Founder, Destiny Transformations Group, LLC (April 2018 – present) | ||

Board Experience ●Masonite International Corp., a publicly traded global designer, manufacturer, and distributor of internal and external doors for the construction and renovation industry, where she serves as a member of the Corporate Governance and Nominating Committee (February 2018 – present) ●Barnes Group Inc., a publicly traded industrial products and aerospace company, where she serves on the Audit Committee (September 2019 – present) ●Thurgood Marshall College Fund, a not-for-profit organization and the nation’s largest organization exclusively representing the Black College Community (January 2017 – October 2018) | ||

| Ms. Jones brings to the Board considerable information technology, global digital technology use, data management and privacy experience as a seasoned C-Suite executive with extensive experience in multinational corporations. Ms. Jones’ digital use and technology expertise and experience provides valuable insights in leading innovative change, technological advancement and strategic growth and is critical to our successful execution of our technology and digital strategies. |

| 20 | AMN Healthcare | 2024 Proxy Statement |

Corporate Governance

| Sylvia Trent-Adams | 58 Committee: Talent and Compensation Committee; Corporate Governance and Compliance Committee Director Since: 2020 | Skills & Qualifications: Healthcare Industry | Government/Policy Advocacy | C-Suite Leadership | Human Capital Management  |

| Qualification Highlights ●President, University of North Texas Health Science Center at Fort Worth (September 2022 – present) ●Executive Vice President and Chief Strategy Officer of the University of North Texas Health Science Center at Fort Worth (October 2020 – September 2022) ●Served in the U.S. Public Health Service Commissioned Corps, including service as Deputy Surgeon General and Acting Surgeon General of the United States (1992 – 2020) ●Held leadership roles in the U.S. Department of Health and Human Services, including as Principal Deputy Assistant Secretary for Health (January 2019 – September 2020) | ||

Board Experience ●University of Minnesota School of Nursing, Board of Visitors (2020 – 2023) ●Institute for Healthcare Improvement, an independent not-for-profit organization, focused on advancing and sustaining better outcomes in health and healthcare (2022 – present) ●One Safe Place, a non-profit organization (2022 – present) | ||

| Dr. Trent-Adams is an active C-Suite healthcare leader and provides the Board with valuable insights as the Company continues to evolve to serve the more diverse needs of our clients and the complexities of large growing health systems and to proactively anticipate their needs driven by changes in care delivery, reimbursement, and other factors. Dr. Trent-Adams’ experience serving in high levels of the federal government health service and understanding of the drivers and development of public policy enhances the Board’s ability to provide effective oversight of clinical quality, government policy and regulatory risk, all of which are critical to the successful design and implementation of our growth strategy. |

| Douglas D. Wheat | 73 Board Chair Committee: Executive Committee (Chair) Director Since: 1999 | Skills & Qualifications: Legal/Risk Management | Mergers & Acquisitions | Finance/Audit  |

| Qualification Highlights ●Managing Partner of Wheat Investments, a private investment firm (2015 – present) ●Founding and Managing Partner of Southlake Equity Group (2007 – 2015) ●President of Haas Wheat & Partners (1992 – 2006) ●Founding member of the merchant banking group Donaldson, Lufkin & Jenrette specializing in leveraged buyout financing ●Practiced corporate and securities law in Dallas, Texas (1974 – 1984) | ||

Board Experience ●Overseas Shipholding Group, a publicly traded ocean transportation services company, where he serves as Chairman (2014 – present) ●International Seaways, Inc., a publicly traded oil and gas tanker company, where he serves as Chairman (2016 – present) ●Former member of the Board of Directors of several other companies including Dex Media, Inc. (Vice Chairman), SuperMedia, prior to its merger with Dex One (Chairman), Playtex Products (Chairman), Dr. Pepper/Seven-Up Companies, Inc., Dr. Pepper Bottling of the Southwest, Inc., Walls Industries, Inc., Alliance Imaging, Inc., Thermadyne Industries, Inc., Sybron International Corporation, Nebraska Book Corporation, ALC Communications Corporation, Mother’s Cookies, Inc., and Stella Cheese Company | ||

| Mr. Wheat brings to the Board significant healthcare staffing industry knowledge as well as extensive expertise in corporate finance and mergers and acquisitions, all of which are critical to the successful design and implementation of our growth strategy. Additionally, Mr. Wheat has significant experience serving the Company under different operating environments, management teams and financial market cycles strengthening the Board’s collective knowledge, perspective, and capabilities to guide the Company through both anticipated and unexpected environments. |

| 2024 Proxy Statement | AMN Healthcare | 21 |

Corporate Governance

| RETIRING DIRECTOR |

| Ms. Marsh will be retiring from the Board effective upon the conclusion of the Annual Meeting. AMN Healthcare and its Board would like to recognize and thank Ms. Marsh for her dedicated and tenured service to the Company and the Board. | ||

| During Ms. Marsh’s 13 years of service on the Board, she has offered tremendous experience and understanding of the challenges and opportunities of large healthcare facilities through her more than 40 years of experience in the healthcare industry. Ms. Marsh has also provided immeasurable leadership and guidance as Chair of the Talent and Compensation Committee for 11 years. The Company and the Board thank Ms. Marsh for her dedicated services and wish her the best in her future endeavors. |

| 22 | AMN Healthcare | 2024 Proxy Statement |

Corporate Governance

Board Effectiveness

| We understand that Board effectiveness is essential to long-term value creation and take steps to ensure our Board is composed of directors that maintain appropriate independence, and possess requisite skills, expertise, experience and diversity characteristics to effectively oversee risks and guide the Company’s strategy. | 01 | 02 | 03 | 04 | ||||

| Director Nomination Process | Onboarding and Education | Board and Committee Self-Evaluation Process | Refreshment |

| 01 | Director Nomination Process |

| Evaluation of Board Composition, Shareholder Recommendations and Nominations and Director Independence |

Evaluation of Board Composition

Our Governance and Compliance Committee understands the vital role that a strong board composition with a diverse set of skills and continuous refreshment plays in effective oversight. The Governance and Compliance Committee values maintaining a diverse board to effectively manage complex corporate issues by leveraging different experiences to support the Company’s long-term objectives and business strategy. With this purpose in mind, our Governance and Compliance Committee seeks out candidates with skills, experiences, and characteristics, including individuals representing historically underrepresented groups, that when working collectively will fulfill its oversight responsibilities and continue to guide the Company into the future.

EXPERIENCE AND QUALIFICATIONSAs part of the Board’s ongoing refreshment strategy and director candidate identification and nomination processes, the Governance and Compliance Committee actively and continuously evaluates its collective composition to identify and prioritize director characteristics, skills, and experiences prior to nominating a new director candidate to the Board for review, approval and appointment. Below is an illustration of the Governance and Compliance Committee’s regular Board refreshment and director candidate identification process.

When assessing and prioritizing desired characteristics, skills and backgrounds, the Governance and Compliance Committee considers, among other things, the Board’s current skill set and tenure, the Company’s long-term strategic plan and objectives, shareholder discussions, current and past board service, commitment to corporate social responsibility and director feedback provided in connection with the Board’s annual evaluation process.

The Governance and Compliance Committee then establishes a diverse pool of potential director candidates who possess the desired characteristics, skills, and experiences; the director candidate slates are identified from various databases and sources, including recommendations from shareholders, management and directors, consultants, and industry experts. When considering candidates for the Board, the Governance and Compliance Committee takes steps to ensure that the pool of candidates includes candidates from historically underrepresented groups. The Governance and Compliance Committee may also engage a third party to conduct or assist with the search or evaluation.

| 2024 Proxy Statement | AMN Healthcare | 23 |

Corporate Governance

Shareholder Recommendations and Nominations

The Governance and Compliance Committee considers shareholder recommendations of qualified director candidates when such recommendations are submitted in writing to the Company’s Corporate Secretary at 2999 Olympus Blvd., Suite 500, Dallas, Texas 75019 Attn: Whitney M. Laughlin, Chief Legal Officer and Corporate Secretary. When evaluating any such shareholder recommendations, the Governance and Compliance Committee uses the evaluation methodology that is described in the “Evaluation of Board Composition” above. To have a director nominee considered for election at our 2025 Annual Meeting of Shareholders, a shareholder must submit the nomination in writing to the attention of our Corporate Secretary and also satisfy the requirements set forth in our Bylaws regarding shareholder director nominees no later than January 19, 2025 and no sooner than December 20, 2024, assuming the date of the 2025 Annual Meeting of Shareholders does not change by more than 30 days from the first anniversary of the prior year’s annual meeting. To have a director nominee included in our 2025 proxy statement for election, a shareholder must submit the nomination in writing to the attention of our Corporate Secretary and also satisfy the requirements set forth in the “proxy access” provisions of our Bylaws no earlier than October 6, 2024 and no later than November 5, 2024. In addition, a shareholder who intends to solicit proxies in support of director nominees submitted under the advance notice provisions of our Bylaws must provide the notice required under Rule 14a-19 promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to our Corporate Secretary no later than February 18, 2025.

The Company received no recommendations for director nominees or director nominations from any shareholder for election to be held at the Annual Meeting.

Director Independence

The Board has concludeddetermined that Mr.director nominees Jorge A. Caballero, Mark G. Foletta, Teri G. Fontenot, R. Jeffrey Harris, Sylvia Trent-Adams, Daphne E. Jones, and Douglas D. Wheat all meet our categorical standards for director independence described in our Corporate Governance Guidelines and the applicable rules and regulations of the New York Stock Exchange (“NYSE”) regarding director independence. Our CEO is qualified to serve onthe only member of our Board whom the Board because he brings considerable audit, financial, healthcarehas not deemed independent.

When making director independence determinations, the Board considered business relationships between LHC Group, Inc. and enterprise risk management experienceOrlando Health, Inc. Orlando Health, Inc. is a client of the Company and LHC Group, Inc. was a client of the Company during the first two quarters of 2023. Ms. Fontenot serves as both an executive officer andindependent director of healthcare companies.Orlando Health, Inc., and served as an independent director of LHC Group, Inc. from 2019 until its sale to United Healthcare in February 2023. We discuss these relationships in more detail in the “Certain Transactions” section below. The Board has designated Mr. Folettaconsidered the nature of these related party relationships and the annual amount of payments we receive from each LHC Group, Inc. and Orlando Health, Inc. The Board determined that neither relationship precluded the Board from making an independence determination for Ms. Fontenot and that the related party relationships fell within our standards of independence.

| Director Independence |

| 24 | AMN Healthcare | 2024 Proxy Statement |

Corporate Governance

| 02 | Onboarding and Continuing Education |

Our director onboarding process is designed to provide new directors with information, context, and perspectives that enables new directors to effectively contribute to the Board’s work. During the initial months after joining the Board, new directors have individual meetings with each of our current directors, including specific committee-focused meetings with the chair of each committee. New directors are also invited to attend all committee meetings to assist in their development. Each new director is also assigned an experienced AMN Healthcare board member to share feedback, provide perspective on boardroom activities and dynamics, help with meeting preparation, and act as a financial expert for its Audit Committee, for which he serves as Chairman. Since February 2017, Mr. Foletta has served as Executive Vice Presidentresource between meetings.

In addition to providing new directors with a library of resources that includes governance, finance and Chief Financial Officercore background documents, key business executives and functional leaders from across the organization meet with new directors to increase their understanding of Tocagen Inc. Mr. Foletta served as the Interim Chief Financial Officer of Biocept, Inc., a publicly-traded diagnostics company, from August 2015 to July 2016our businesses, operations, culture and he also served as Senior Vice President, Financevalues. Throughout their tenure, directors participate in informal meetings with other directors and Chief Financial Officer of Amylin Pharmaceuticals, Inc. from March 2006 until October 2012. From March 2000 to March 2006, Mr. Foletta served as Vice President, Finance and Chief Financial Officer of Amylin. Mr. Foletta received a Bachelor of Arts from the University of California, Santa Barbara. He is also a Certified Public Accountant (inactive) and a membersenior leaders of the Company to share ideas, build stronger working relationships, gain broader perspective and strengthen their working knowledge of our business, strategy, performance and culture.

We encourage and facilitate director participation in continuing education programs and each director is provided membership in the National Association of Corporate Directors Forum.

BOARD EXPERIENCE

Since February 2013, Mr. Foletta has served as awell as subscriptions to other governance publications and resources. Directors are also encouraged to attend director education programs at Company expense, provided that such expenses are pre-approved by the Chief Legal Officer.

| 03 | Board and Committee Self-Evaluation Process |

In line with our value of Regulus Therapeutics Inc., and is Chairman of its Audit Committee and a member of its Nominating and Governance Committee. Since November 2014, Mr. Foletta has also served on the Board of DexCom, Inc., a publicly-traded company, where he is the Lead Director. Additionally, Mr. Foletta serves as acontinuous improvement, each director of Viacyte, Inc., a privately held company. From August 2015 to July 2016, he served as a director and Chairmanconducts an evaluation of the Audit Committee of Ambit Biosciences Corporation (sold in 2014), and also served as a director of Anadys Pharmaceuticals, Inc. (sold in 2011).

AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement7

|

| ||||||||||||||

EXPERIENCE AND QUALIFICATIONS

The Board has concluded that Mr. Harris is qualified to serve on the Board because he brings considerable mergers and acquisitions experience, which is a key component of the AMN’s strategy. Additionally, Mr. Harris has experience serving as a director on public company compensation and corporate governance committees, which is essential to designing and maintaining our executive compensation programs and developing our succession planning strategies. Mr. Harris served as Of Counsel at Apogent Technologies, Inc. from December 2000 through 2003, and as Vice President, General Counsel and Secretary from 1988 to 2000, when the company was named Sybron International.

BOARD EXPERIENCE

Since 2002, Mr. Harris has been involved as an investor in, and a director of, early stage companies. Mr. Harris served on the Board of Sybron Dental Specialties from April 2005 until it was acquired by Danaher Corporation in 2006. Mr. Harris served on the Board of Playtex Products, Inc. from 2001 until Energizer Holdings acquired it in October 2007. Mr. Harris was director of Prodesse, Inc., an early stage biotechnology company, from 2002 until 2009, whenGen-Probe Incorporated acquired it. Mr. Harris also served as director of Apogent Technologies, Inc. from 2000 until Fisher Scientific International, Inc. acquired it in 2004. Since 2008, he has been a director of Guy & O’Neill, Inc. He currently serves on the Board of Brookfield Academy, anon-profit entity, and is Chairmanperformance of the Board and each committee for which they serve on an annual basis. Additionally, on aco-founder biennial basis, the Chair of BrightStar Wisconsin Foundation, Inc., anon-profit economic development corporation. Additionally, Mr. Harrisour Governance and Compliance Committee conducts individual conversations with each director. Each step of the Board’s annual evaluation process is a directorfurther illustrated below.

| 2024 Proxy Statement | AMN Healthcare | 25 |

Corporate Governance

8 AMN HEALTHCARE SERVICES, INC.ï 2018 Proxy Statement

| 04 | Refreshment | |||||||

|

Board Refreshment

| ||||||||||||||

|

| |||||||||||||

EXPERIENCE AND QUALIFICATIONS

We prioritize effective and aligned Board composition, supplemented by a thoughtful approach to refreshment. It is essential to have a qualified group of directors with an appropriate mix of skills, experience and attributes to oversee our strategic objectives. The Board has concludedGovernance and Compliance Committee continuously reviews the Board’s composition, taking into consideration the characteristics of the existing directors, both individually and as a group. Ongoing strategic board succession planning, led by the Governance and Compliance Committee, ensures that Dr. Johns is qualified to serve on the Board because he has extensive“C-suite” leadershipcontinues to maintain an appropriate mix of objectivity, skills and healthcare experienceexperiences to provide fresh perspectives and is a recognized healthcare thought leader. This expertise is vital in shapingeffective oversight and guidance to management, while leveraging the institutional knowledge and historical perspective of our strategy to deliver innovativelonger-tenured directors.

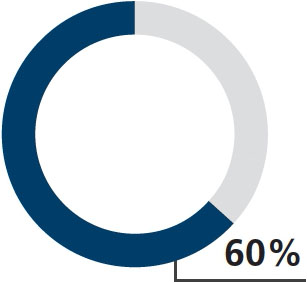

Currently, over 60% of our director nominees served less than six (6) years, and expanded service offerings as a healthcare workforce solutions company. Dr. Johns is a Professor in the Schoolour director nominees have an aggregate tenure of Medicine at Emory University, where he also served as Chancellor from October 2007 through August 2012. Dr. Johns served as Interim Executive Vice President of Health Affairs for Emory University and as Interim Chairman and CEO of Emory Healthcare from September 1, 2015 through January 31, 2016. He served as the Interim Executive Vice President for Medical Affairs and Interim Chief Executive Officerless than ten (10) years. Each of the University of Michigan Health System from June 2014 through March 2015. From 1996five (5) directors that we have added to 2007, Dr. Johns served as Executive Vice President for Health Affairs and Chief Executive Officer of the Robert W. Woodruff Health Sciences Center of Emory University. From 1990 to 1996, Dr. Johns was Dean of the Johns Hopkins School of Medicine and Vice President of the Medical Faculty at Johns Hopkins University. From 1990 to 1996, Dr. Johns was Dean of the Johns Hopkins School of Medicine and Vice President of the Medical Faculty at Johns Hopkins University. Dr. Johns is a member of The National Academy of Medicine of the National Academy of Science.

BOARD EXPERIENCE